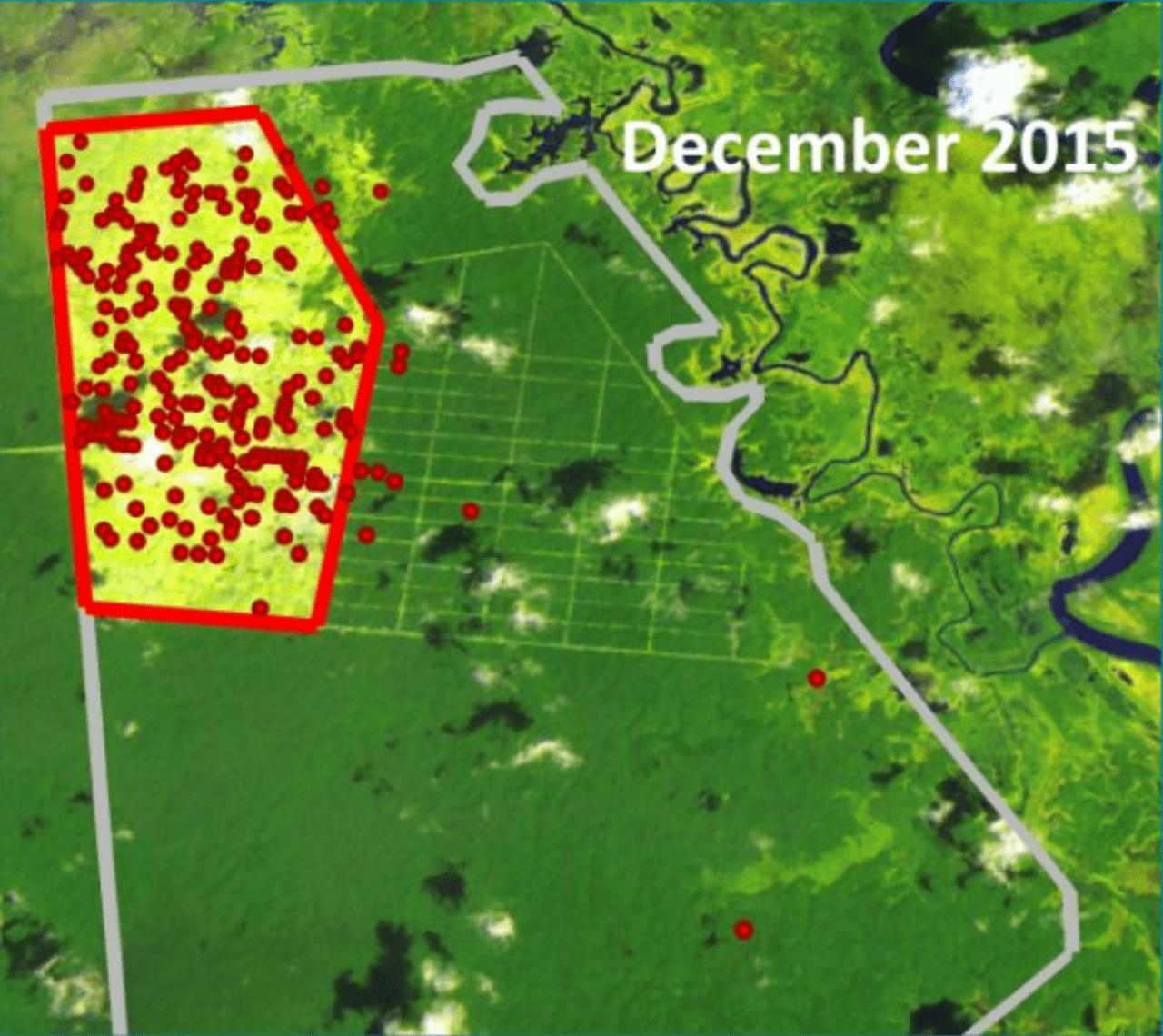

Image showing fire hotspots recorded on land owned by the Korindo company PT Papua Agro Lestari in December 2015

Banks owned by the Indonesian government are

funding illegal activities by large-scale palm oil companies that are undermining

high-profile policy commitments made by the country’s President to reduce

greenhouse gas emissions.

Three banks majority-owned by the state – Bank Mandiri, Bank

Rakyat Indonesia and Bank Negara Indonesia – have ploughed billions of dollars

into an industry that is systematically undermining the rule of law and

efforts to repair Indonesia’s reputation as a climate villain in the wake of

catastrophic forest fires.

The companies financed by the three banks are clearing and

draining peatlands and stand accused of failing to avoid fires in areas under

their management. Some are even alleged to have deliberately started fires to

clear land. All of these acts are, to varying degrees, illegal or criminal in

Indonesia.

The evidence has been laid bare in a new report by Aidenvironment, commissioned by the

NGO Rainforest Foundation Norway. It provides detailed allegations against

seven palm oil companies operating across the islands of Sumatra, Kalimantan,

Sulawesi and Papua.

The Korean-owned conglomerate Korindo, the largest palm oil

company in Papua, is alleged to have intentionally used fire in the

course of clearing for its plantations. It has destroyed 30,000 hectares

of tropical forest for palm oil since 2013.

“All evidence – satellite imagery, hotspot data, and aerial

photographs – pointed to systematic and abundant use of fire during Korindo’s

land clearing processes,” the report states. “This is illegal in Indonesia.

During the 2013–2015 period, all Korindo’s land clearing to establish oil palm

plantations was accompanied by burning.”

Korindo has been financed by the state-owned Bank Negara

Indonesia.

Sampoerna Agro, which is embroiled in land rights conflicts,

is currently being prosecuted by the Indonesian Ministry of Environment and

Forestry for failing to mitigate fires in its concessions. The Ministry alleges

that Sampoerna made “no effort” to prevent fires spreading inside and outside

its concession in 2014, according to the report.

In August 2016, a court ordered Sampoerna to pay

approximately US$80 million for compensation and ecosystem restoration.

Sampoerna has appealed the verdict. It also has outstanding loans amounting to

more than two trillion Rupiah from the three Indonesian state banks.

While development on peatlands more than three meters deep

has been prohibited in Indonesia for several years, the government has taken

several measures to prohibit all expansion into peatland since Indonesia’s

peatlands were the site of massive fires in 2015.

Peatlands, which function like a wet sponge in their normal

conditions, become highly combustible when drained for plantation development.

As in 2015, the fires are almost impossible to control when they begin and

generate vast greenhouse gas emissions.

The evidence suggests that almost all of the companies

financed by state banks are in violation of the measures taken to prevent

further exploitation of peatlands, including planting on burned land.

An analysis by the NGOs Rainforest Action Network and TUK in

2016 found that, according to their public policies, the three state owned

banks had no measures in place to avoid financing of such illegal activities.

None of the banks required proof of legality in the

operations of their clients, or checked the legality of their land tenure.

According to their policies, they do not commission independent assessments of

legal compliance.

The Aidenvironment report principally highlights the role of

Norwegian financial institutions as investors in the Indonesian banks. Over

recent years the Norwegian state pension fund has led the sector in divesting

from environmentally harmful activities, including many palm oil firms.

However, it may still be benefiting from illegal deforestation through

their investments in the Indonesian government-owned banks.