Ukrainian activists say America’s business in Russian wood banned in the EU and Britain is helping to fuel Putin’s invasion and further enrich his cronies.

Key Findings

- US business in “conflict timber” banned in the EU and Britain is helping fund Russia’s invasion of Ukraine and further enrich powerful oligarchs, Earthsight can reveal.

- Our investigation, published today to coincide with the first anniversary of Putin’s aggression, found punitive American tariffs against Moscow have failed to halt imports of Russian wood.

- More than 260,000 cubic metres of Russian ‘Baltic birch’ plywood (with an estimated retail value of $1.2bn) has landed at US ports since the conflict began, customs records show. EU officials say it is “impossible” to know where this wood really originates – and therefore who profits from it. The suspect plywood is being sold across the United States, including by one of its largest home improvement retail chains, Menards.

- Earthsight found one of the top suppliers of the sought-after construction and furniture materials is a company part-owned by a billionaire Kremlin crony who met with Putin on the day of the invasion. Earthsight estimates he has made $44m from his stake since the invasion.

- What’s more, Russia’s military owns an area of forest twice the size of New Jersey, Earthsight has discovered. More than a million cubic metres of logs are harvested there each year. US importers cannot be sure their products are not directly fuelling the Russian war machine.

- Meanwhile, International Paper, the world’s largest forest products maker, earned $203m in the 10 months following the invasion from a Siberian business it co-owns with two Putin allies. Though it has recently announced a deal to sell its stake, for a paper loss, it has yet to be completed.

- The Memphis-registered pulp and paper giant’s Ilim Group, we found, had in the meantime continued to purchase timber from logging firms fined millions for rampant illegal logging.

- Responding to our findings, Ukrainian activists again urged Washington to sanction Russian wood supplies, calling the continued profits we exposed “blood money”.

Log loading bay in Irkutsk Oblast, Siberia.

Timber traders, soldiers, ply

World condemns Putin’s invasion

On 24 February 2022, Russian troops invaded Ukraine from several fronts including staging posts in Belarus. International outcry was swift. More than 120 NGOs including Earthsight in March 2022 signed an open letter calling for Western sanctions on Russian wood imports.1 Signatories included activists and environmental and human rights groups from Ukraine, Belarus, the United States and across Europe.

Their joint statement called for governments of countries allied to Ukraine, including the European Union, Britain and the United States of America, to immediately “ban imports of all types of Russian and Belorussian timber and wood products (including all paper products, furniture and furniture parts, pellets and sawn wood)” – a multi-billion-dollar trade they noted was, and is, helping to finance Russia’s invasion. At the same time, Earthsight published an exposé revealing how five of Russia’s biggest timber exporters to the West are owned and run by oligarchs with past or present ties to the Putin regime.2

After the letter was published, the EU and UK added timber to their trade sanctions on Russia.3 They also imposed financial sanctions on three of the oligarch owners Earthsight had identified.4 Even before the sanctions took effect, EU officials had concluded it is “impossible” to check whether wood from Russia is legal and sustainable after international timber certification bodies either scaled back or ended operations in the country following Putin’s aggression.5

The two leading ethical labels, the Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC), blacklisted wood emanating from Russia and occupied Ukrainian territory. PEFC called it “conflict timber”.6 As did America’s largest woodworkers’ union.7

Despite strong rhetoric and sanctions on a wide range of Russian goods, the United States did not follow its European allies in banning imports of wood and related products. Instead, Washington raised tariffs on Russian birch plywood to 50 per cent as part of sweeping legislation ending normal trade relations with its former Cold War rival.8

If US lawmakers aimed to halt Russian timber imports, they failed.

The largest American firms involved in this trade, those under the most scrutiny from the press and investors, voluntarily ceased importing Russian plywood following the invasion.9 However, Earthsight has found other firms continued regardless. Plywood is now one of the largest remaining trading relationships America has with Russia. Customs records show plywood accounted for more than half of, or 186 of a total 369, Russian goods shipments to the US during the period 10 November 2022 to 21 January 2023.

Plywood is now one of the largest remaining trading relationships America has with Russia

After an initial decline in trade following the invasion, US imports of Russian birch ply in October 2022 actually exceeded the volume recorded in February of that year, when the war began (see chart). The value of these goods declared to US customs officials remains much lower because of a big fall in declared values per cubic metre. This discrepancy is highly suspicious and may indicate importers illegally under-declaring the value of their shipments to reduce the impact of the new tariffs.

Customs records show the US imported 260,624 cubic metres of plywood from Russia over the first 10 months since the invasion (March-December 2022). Earthsight estimates this wood has a retail value of $1167 million.10

Unlikely bedfellows cash in

Trawling through shipment records for Russian exports and US imports, Earthsight identified 23 American companies which have continued to receive Russian ply since the war began.

The biggest importer we identified is Price Gourin Wood Imports, also called PG Wood. PG accounted for over a third of the total volume of Russian plywood Earthsight was able to trace using shipment records arriving at US ports during the six months to January this year. It received three shipping containers’ worth of the materials on average each day over the period.

PG has received Russian plywood with an estimated retail value of over $147m since the invasion began. More than half of these imports arrived after the hefty US tariffs on Russian goods took effect.

Georgia-based PG’s suppliers include Vyatsky Plywood, a subsidiary of Segezha, Russia’s largest logging firm. Earthsight previously linked Segezha to Vladimir Yevtushenkov, the billionaire oligarch who toured occupied Crimea with Russian President Vladimir Putin in 2015, and was among a select group of oligarchs who met with Putin on the day of the invasion in February 2022.11 Since we reported this connection last March, both the UK and Ukrainian governments have added Yevtushenkov to their sanctions lists. The US has not followed suit.

Segezha claims UK sanctions do not affect it because Yevtushenkov only owns a 30.5 per cent stake.12 This statement, while true, omits that the controversial billionaire nevertheless still shares in Segezha’s profits, including those from selling plywood to the USA. Based on Segezha’s declared accounts for the period January to September 2022, Earthsight estimates the firm has banked $144m in profit since the war began. Of this, an estimated $44m is due to be shared in dividends with Yevtushenkov.13

PG isn’t the only US firm still doing business with Segezha. The Russian company was America’s fourth largest plywood supplier in recent months, with shipments topping 1,200 cubic metres per month.14 Another of its US customers is Dmitat Enterprises, which trades as Plyco International. The New Jersey-based firm specialises in distributing hardwood plywood products for concrete forming, underlayment, packaging and furniture. Its owner, Dmitri Roujanovski, certainly isn’t doing too badly: he resides in a $1.85m mansion he bought with his wife in 2019, in the leafy New Jersey borough of Little Silver.15

The $1.85m New Jersey mansion of Dmitri Roujanovski, owner of one of the firms still importing Russian plywood linked to oligarchs there.

Neither PG nor Dmitat responded to requests for comment.

Though Yevtushenkov has yet to be sanctioned by the US, his fellow oligarch Alexei Mordashov, Russia’s richest man, wasn’t so lucky. The US sanctioned Mordashov and companies under his control back in June 2022.16 The move encompassed all firms majority owned by him, directly or indirectly. At the time this included his timber firm Sveza, which has previously bragged of supplying plywood used to build the Olympic stadium in the 2012 London Games, and a former Trump Tower hotel in Toronto, among other major projects.17 Mordashov (who was also among those businessmen who met with Putin on the day of the invasion) moved quickly to try to circumvent the sanctions by handing over a controlling stake in the firm to Sveza’s top managers.18 But he still owns a 49 per cent stake19, and thus continues to draw significant benefit from the firm’s business.

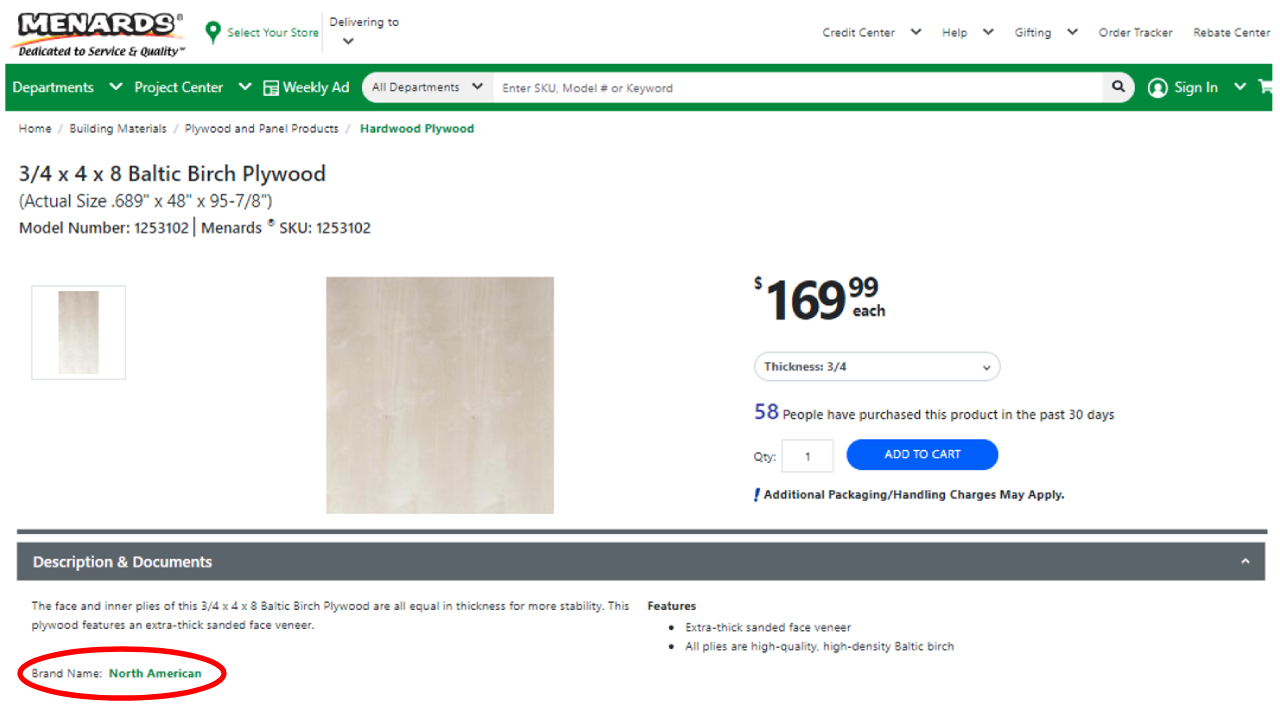

This shapeshifting might explain why Russian customs records obtained by Earthsight show two plywood shipments from Sveza to the US in early August. Both were destined for North American Plywood Corporation (NAPC), the third largest American buyer of Russian plywood in recent months. Its plywood ends up in recreational vehicles, trucks, children’s furniture and concert speakers.20 ‘North American’ brand plywood supplied by NAPC is being offered for sale in the US by Menards, the US’s third-largest home improvement retail chain.21 Menards’ owner, John Menard Jr, is one of the 100 richest people on the planet.22 His wealth increased by over $2bn in 2022.23 Both NAPC and Menards failed to respond to requests for comment.

Russian Baltic birch plywood imported by PG Wood.

‘North American’-brand Baltic birch plywood on sale on Menards’ website, 20 Feb 2023.

The records show no further shipments from Sveza to the US since August 2022. However, Earthsight’s research shows this does not necessarily mean the US firms still importing plywood from Russia are not still unwittingly connected to the Mordashov-linked firm. Russian records we obtained show a number of Sveza’s logging subsidiaries indirectly send raw materials to other plywood manufacturers in Russia that are major suppliers to American companies.24

An Executive Order issued by US President Biden in March 2022 and banning imports of Russian seafood, diamonds and vodka, already gives the Secretary of the Treasury the authority to sanction other goods without seeking the permission of Congress or the President.25 Gold has since been added to the banned list. But timber has not. This needs to change.

Logging site in Irkutsk Oblast, Siberia.

“Siberian cash cow”

The paper giant and the Putin cronies

The American companies named above are not the only ones continuing to profit from so-called “conflict timber” from Russia. The world’s largest pulp and paper maker has also been doing so.

Soon after the invasion, Earthsight published a briefing exposing the links between Western businesses and ultrawealthy Russians close to Putin, whom we called “timber oligarchs”. One of the Western firms we named was International Paper, whose shares are listed on the New York Stock Exchange. The US-headquartered forest products giant owns a 50 per cent stake in a vast pulp and paper enterprise in the Siberian region of Irkutsk. This sprawling venture controls an area of forest almost as large as Indiana.26

International Paper co-owns Ilim Group with two billionaire Russian oligarchs, Zakhar Smushkin and Boris Zingarevich. Putin crony and former Prime Minister Dmitry Medvedev helped found their firm. Medvedev, a vocal supporter of his former boss’s invasion of Ukraine, calling it a “sacred battle against Satan”27, was sanctioned by the US in April 2022.28 Though Medvedev is no longer an Ilim shareholder, its oligarch owners retain friendly relations with the Russian President. Smushkin, for one, has shared a platform with Putin at numerous business conferences in recent years.29 Ukraine sanctioned both him and Zingarevich in the wake of the war. Its Western allies have yet to follow suit.

Smushkin seated next to Putin at a business conference in Moscow, March 2019.

Ukraine’s justification for the sanctions referred to the fact that Russia’s forests are state-owned, and thus Ilim is a big contributor to Putin’s war chest. But there is more to it than that. The Russian military directly owns a significant chunk of the country’s forests and profits directly from logging there. Putin’s generals control an area of forest more than twice the size of New Jersey30, which produces in excess of one million cubic metres of logs a year.31 This woodland empire includes land in Ilim’s home region, Irkutsk. It is therefore possible Ilim’s supply chains contain timber from military-owned forests. The same is true of the supply chains of the Russian firms still flooding America with birch plywood.

Given that EU officials have concluded it is now “impossible” for Western firms to be sure where their Russian wood comes from, it is hard to see how International Paper or the US plywood importers could ensure wood from forests owned by the Russian military is not entering their supply chains.32 (see 'Europe’s belated sanctions’ for more details on EU sanctions targeting Russian wood.)

The Russian wood landing on US shores could be coming from forests owned by the Russian military

Referring to International Paper’s controversial holding as its “Siberian cash cow”, The Wall Street Journal reported in November 2022 that Russia remains a “major source of cash” for the paper giant, as well as an important contributor to the big dividends it traditionally disburses.33 These dividends, among the highest of any firm in the S&P 500, in turn have made International Paper’s shares popular with investors including US pension funds.

Europe’s belated sanctions

Until recently, European firms were also carrying on business with Ilim as normal. They didn’t choose to stop: lawmakers forced them.

Unlike the US, the European Union responded to calls from Ukrainian civil society and announced in April 2022 it would impose sanctions banning wood from Russia in response to the country’s invasion of Ukraine earlier that year.34 The sanctions took effect at the beginning of July.35 However, the measure exempted most pulp and paper imports from the former superpower.

An Earthsight analysis identified the biggest beneficiary of this loophole: Ilim Group. Our analysis found it sold wood products worth some €40m to the EU over the period July to December 2022.36

It took until late last year for the EU to clamp down on this trade, when it expanded the sanctions to cover the remaining categories of Russian wood products.37 The last legal imports took place on 8 January this year.

Pension funds profit

Ilim shelled out $204 million in dividends to International Paper in March 202238, and another huge windfall is due soon.

After Earthsight drew attention to International Paper’s controversial holding, the pulp and paper giant announced on 11 March 2022 that it intended to “explore […] the possible sale” of its 50 per cent share in Ilim Group.39 But a deal to sell its interest was not announced for another 10 months, and has yet to be implemented as it awaits approval from Russian authorities.40 In the meantime, International Paper continued to rake in profits from Ilim. Within nine months of International Paper making its as-yet-unfulfilled promise to sell Ilim, financial records examined by Earthsight reveal its Russian venture had contributed a further $203 million of profits.41

The firms ultimately profiting from these controversial gains include the world’s two largest asset managers, BlackRock and Vanguard. Vanguard alone holds shares in International Paper worth $1.4bn.42

International Paper’s other stockholders include funds advertising themselves as ethical, such as the Finnish Nordea 1 Global Climate and Environment Fund, which claims to invest only in firms “changing the world for the better”; Norwegian Pension Fund Global (Norway’s sovereign wealth fund); and California Public Employees’ Retirement System (CalPERS).

None of these investors offered comment when approached by Earthsight in advance of publication.

International Paper has paid out half a billion dollars in dividends to shareholders on its profits since the invasion began, and is due to distribute a further $165m on 15 March. Earthsight calculates that Norway’s supposedly ethical sovereign wealth fund has received over $710,000 in dividends resulting from Ilim’s operations since Russian troops crossed the Ukrainian border early last year; CalPERS, a further $220,000.43

It is doubtful that California’s public workers, or Norway’s citizens, would be comfortable about this if they knew.

Meanwhile, in Ukraine, bombs continue to rain down.

Vast log rafts with the Ilim Group Bratsk pulp mill in the distance - Bratsk, Irkutsk Oblast.

Illegal logging links

The fact that International Paper continued to profit handsomely from Ilim for so long is made more troubling by a previous Earthsight investigation that found its Russian venture had sourced large volumes of illegally harvested logs from one of Russia’s richest wood barons.

Our July 2021 report IKEA’s House of Horrors44 revealed how companies connected to Evgeny Bakurov, ranked 44th on Forbes Russia’s list of wealthiest politicians in 201945, had logged millions of trees in protected Siberian forests on the false pretext they were diseased or damaged. We traced some of this wood from Ilim’s home region of Irkutsk to IKEA, the world’s largest furniture retailer. Some of the trees cut down illegally in climate-critical forests were used to make children’s furniture sold in the Swedish firm’s stores across the globe.

IKEA wasn’t the only buyer, however. Russian records show Ilim Group purchased 255,196 cubic metres of logs from Bakurov’s firms to feed its huge mill in 2020 alone.46 Now, fresh evidence uncovered by Earthsight shows business between Bakurov and Ilim Group has continued. Official records we obtained show Ilim Group bought 34,896 cubic metres of logs from Bakurov’s trading outfit Kapel LLC in November last year. Bakurov-owned logging outfits – Vertical-B, Vilis, Kalinov Most, Noviy Les and DeepForest47 – in turn, still supply timber to Kapel, we found.

A 334 million rouble ($5 million) fine imposed on one of Bakurov’s logging companies in May 2022 confirmed our findings48 – and further penalties for his logging firms followed late last year. To date, these total over 1.8 billion roubles, or $26 million.49

International Paper’s Russian joint venture bought wood from firms fined millions for illegal logging

These logging firms were, and still are, mired in controversy. They lost their lucrative FSC and PEFC timber supply chain accreditation after the certification schemes withdrew from Russia in response to the invasion of Ukraine. Still business with Ilim carried on.

Bakurov, meanwhile, has publicly supported Putin’s warmongering50 and now shifted his political allegiance to the President’s ruling United Russia party.51 Facing re-election later this year, Bakurov has also transferred nominal ownership of his lucrative timber empire to a long-standing partner in an attempt to distance himself from the ongoing controversy surrounding it.52 Speaking to Earthsight, a Russian source decried the move as a sham, as they insist Bakurov remains the companies’ true owner.

International Paper’s belated recent announcement that it has agreed a deal to sell its stake in Ilim provides little comfort across the border with Ukraine. Speaking to Earthsight, environmental and anti-corruption activists there cautiously welcomed the move, but point out the long delay in International Paper’s action allowed the forest products giant to reap a windfall while artillery shells struck hospitals, schools, homes and thousands of civilians’ buildings, not to mention people, in their homeland. Reached for comment, International Paper simply referred Earthsight to its recent announcement of the sale of its Russian joint venture.

“This is blood money” – Yehor Hrynyk, Ukrainian activist

Responding to Earthsight’s findings, the Ukrainian activists behind the original joint letter reiterated their calls for America to ban wood imports from Russia and urged other Western timber firms still active in Russia to follow International Paper’s belated lead and divest immediately.

Yehor Hrynyk, a forest conservationist with the Ukrainian Nature Conservation Group, said “Buying Russian wood provides funds for Putin’s war and lines the pockets of super-rich oligarchs. America must follow the EU and Britain in stamping out the conflict timber trade. How many times must we shout this before Washington takes action?”

Of International Paper’s decision to sell Ilim Group, he added “It’s the right decision but it came far too late. Month after month, International Paper earned millions from Ilim Group while Ukraine suffered appalling devastation and horror. It’s blood money.”

He also noted that a number of other Western timber firms continue to operate in Russia, and called for them to follow International Paper’s belated action.